There have been many Teaching Tuesday lessons on importance of teaching your children to be good stewards of the money so you know this is near the top of my list. Over the weekend, I heard an expert in the world of real estate and finance asked the question, “Why is it so hard for young adults to purchase their first home?” The interview was on rising prices for necessities, increased interest rates, and new potential home buyers, etc. Her response was so right on point when she answered, “They need to start saying no to the things that aren’t necessary, the fancy coffee on the way to work, the non essential shopping trip to the discount retail store, the things your really don’t need online that can be delivered in less than 24 hours, the dinners out or delivered in because you just are too lazy to go to the kitchen to make your meal yourself, that’s what a good part of the problem is.” “YES!” I thought.

Over the weekend, I also saw an Instagram Reels video of a young man pricing out what a fancy coffee drink would cost you to make at home. He went through the coffee grounds, coco powder, milk, teaspoon of vanilla, sweetener and how much each cost, and when he was done, the large (Venti, at the fancy chain coffee store) was right around 70 cents, compared with around $6.00 plus (and then tip, if you tip) at the coffee store. Let’s say someone stops for fancy coffee on the way to work, let’s say at $5.00 per day for 5 days a week, that’s $25.00 per week, 4 weeks in a month so that’s $100 per month in coffee out and over a year, $1,200. Compare that to $.70 per day, times 5 days, $3.50 per week, $14 per month, times 12 months would be $168 per year for coffee on the way to work. This would add up to a savings of $86 per month and an annual savings of $1,032 per year. How about you buy a good looking knock off cup that looks like one of those big name drink cups, or you find your own special cup to drink your preferred morning drink out of from a discount store and get creative with the ingredients you have in your own kitchen, milk, coffee, flavoring, coco powder, or a special tea with bags and flavorings at home. You can find a drink that appeals to you with a quick search on your phone typing in the ingredients that spark your interest. That’s just a savings in coffee!!! So where else could you save/teach a lesson?

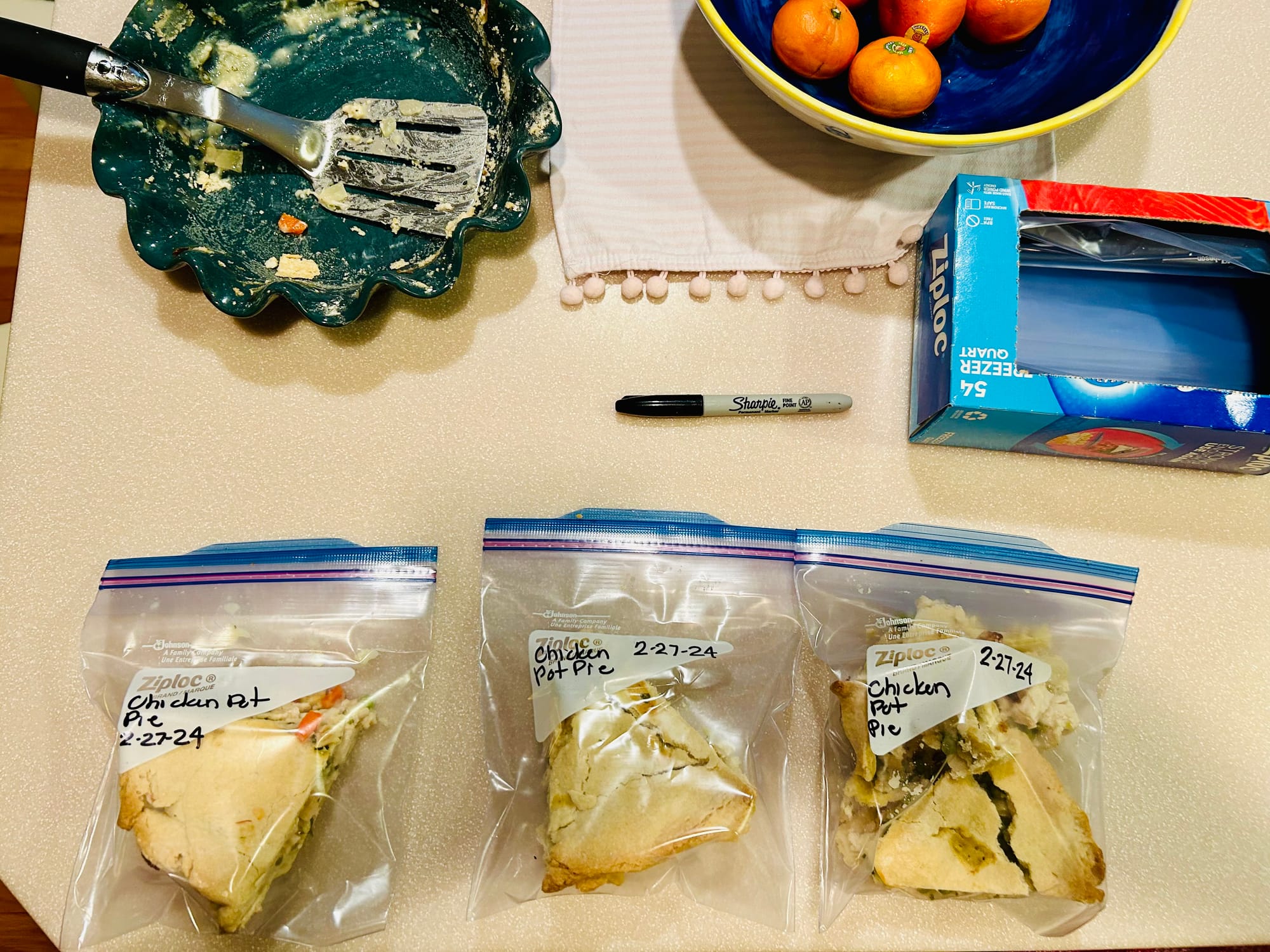

Make food at home as much as possible; you know what is in it, you keep costs down and you know your kitchen is clean. Why wouldn’t you as much as possible?

Since everyone has to eat, let us start with food. Have a conversation with your kids about meals. Start with breakfast. Rather than a breakfast on the go out, why can’t they make their own healthy breakfast? Consider a protein shake, if that is of interest to them. Again, look up recipes that include the fruits/flavors they like, a protein powder or protein through peanut butter, milk or yogurt. This is a good opportunity to explain that breakfast is the most important meal of the day and that enough protein to start the day, will fuel their brain and rest of their body to perform their best in school or in the work place. If protein shakes aren’t their thing, what about a nutritious breakfast sandwich with an egg on good bread, which could be made at home (try my Homemade Rustic Bread, here on the website made with ingredients you probably have at home, maybe you need yeast if you don’t have it, add it to the grocery list), you can include an over hard egg, a slice of cheese on good bread and a banana to be eaten at the kitchen counter or on the go. Have a nice bottle of water from your refrigerator in their own ‘special’ water bottle and there you go! Or consider the new, which really isn’t new, “Overnight Oats” on my website it’s Bircher Muesli ), with a boiled eggs. Breakfast, no problem and it’s healthy and will help your child to be more productive whatever their morning entails…Lunch, again made by them, a healthy sandwich, a good salad, a bowl, soup made in your own kitchen or an Encore Meal (really leftovers from a good dinner the night before). Purchase the containers necessary and a delicious, healthy meal made with ingredients you are aware of and prepared in your clean kitchen will not only benefit your body but your bottom dollar as well. If you kids are allowed to order fast food out, compare the costs with what it cost to do it yourself. Eating an Encore meal that is already in your fridge compared to the price of food delivered in, is a no brainer. Remember, Peanut Butter and Jelly sandwiches are always an option too. Add some honey, sliced bananas or any other item that appeals to you can make the most basic sandwich interesting. PB, honey and banana sandwiches were my go to in high school in a brown bag with an apple and homemade Chex Party Mix (it wasn’t available premade in bags back then).

What about subscriptions? Do you really need all of the ones you have? Can you get rid of Satellite Radio if you already have Spotify, Apple Music or Pandora? How about the movie subscriptions? Do you really need Netflix, Amazon Prime and Disney Plus? Can you find one that covers most of the shows you watch and be good with that? Put your thinking cap on and get to figuring out what you can do without. I am not saying cut out everything, just 1 music streaming and 1 movie, or is there a platform that does both and you could do some eliminating there?

Clothes. I know this is mostly a problem for parents of girls, I was a teenage girl and I raised one. Lululemon was not around for me or my daughter, but fancy athleisure would not have been available to me or my daughter, unless it was purchased used, deeply discounted or handed down from a family friend. NADA. To spend $70 plus for fancy sweats or workout clothes is not something I would have participated in, nor would my mother have allowed. This is a good time for a lesson in, “How can we get that look for less?” There are stores like Old Navy and I am sure others, that make very similar looking items. I have purchased very similar quality leggings, workout tops and undergarments for a fraction of the cost. Poshmark is an option for selling and purchasing very good quality brands. You can either get a check, direct deposit or get CREDIT to be used to purchase items on Poshmark, I have done this and it is amazing how much you can sell. Yes, it doesn’t take time, they take a portion, they need to make money to offer such an outstanding platform for such activity, but really, what a good use of a Saturday afternoon for a young girl to get rid of some clothes, shoes, accessories she no longer wears. Same with workout shoes, dress clothes, teach your kids to shop sales, buy used, to be smart.

The frivolities like nails, hair highlights, are things that add up. Does your teenager really NEED them? Can they do their own nails? If you pay for these or any things like these, you are giving you stamp of approval. Any services you pay for, your teenager will think is a necessity and they may come to expect you to pay for this. You could be setting yourself to spend money you may get tired of spending. Even if your daughter works and wants to pay for these services herself, ask if it is really necessary on a regular basis? As an adult who works or who has paid their dues, for you to spend your money as you wish and splurge on the things that are of value to you, that is your choice, it’s your money. Your teenagers are a different story. For them to come to expect this from you, or to think this is a necessity maybe be hard for them when they are starting out. These are expenses they can add to their life, when they can afford it. You are teaching and setting the stage for your son or daughter and possibly for a future spouse. Consider the amount of money you spend as a parent once your teenager starts driving, insurance, drivers’ training, gas, maybe the cost of an extra car in the family for them to drive. If your child needs to drive, these costs are necessities along with a cell phone and possibly computer or tablet. To pay for services that your child may not need, add up and you may need to consider what things you want/can afford to pay for. It all adds up and if they need more education in the form of a trade school or college, your household spendings will go up. Be careful what you take on. YOU are the parent and sometimes saying no is the best thing for you and them. Any financial problems your child encounter under your roof, or after they turn eighteen, potentially affect you. Consider that.

As parents, you can teach your kids to be good steward of their finances. With there being such a shortage of people who want to work, you teenager can surly get a job, babysitting, working in a restaurant, doing landscaping, housesitting, walking dogs, helping elderly people who need jobs done around their home and in other ares. Help your child establish a bank account, designate what your family feels is acceptable to charity/church/synagogue, what is acceptable to have as spending money and what is appropriate to save. If your child is an athlete or participates in an activity that prepares them for a scholarship, that is their job and they may not have time for outside employment. Encourage your child in their activity/sport. Reinforce that THIS is their job and that their time needs to be spent on academics and taking care of their body to perform, getting enough sleep, adequate good nutrition and appropriate workouts.

Setting a good financial foundation early on, can contribute to a healthy fiscal future. As well as your guidance and instruction you may want to enroll your student in Dave Ramsey* class or listen with them to his radio program or other financial experts such as Charles Payne* or Suze Orman*. Both have written excellent books on common sense finance as well.

Good financial skills learned early on can help lead to many Great Days 🍎

*Dave Ramsey-website: Ramseysolutions.com Podcast: The Ramsey Show

*Suze Orman-website: suzeorman.com Podcast: Suze School

*Charles Payne: Podcast Unstoppable Prosperity