In the past, I have had other lessons on the topic of finances. This one goes a little deeper. No matter what anyone tells us, a dollar no longer goes as far as it used to. We can purchase less with our money than we are used to. Everything is more expense than it used to be. Just look at how eggs and milk have gone up. Do your kids know this? They should. This is a good discussion because someday, THEY will be grocery shopping. Explain in the discussion why groceries have gone up in prices. A big part of it is that gas costs have risen and the food has to be transported to the grocery store and if companies are paying more for fuel so that the truck can get the goods to the grocery store, that’s a big part of it.

On another occasion, explain to them how important it is not to waste food when you are paying so much for groceries. I’m not talking, “Clean your plate because there are children across the world who don’t have food to eat and you do.” That really doesn’t work because your kids may have not connection across the world and it puts guilt on to your children. I don’t like that. Here’s a different approach. “Remember we talked about how things are more expensive and Mom and Dad’s money doesn’t go as far as it used to?” Well, let’s come up with ways, sort of like a game, a challenge, as to how we can make the most of what we have so we don’t waste? Mom hates to waste anything, because we work hard for the money we have and we should be good caretakers of what we have, just like we take care of our house, our yard and the other things we own. What do you think

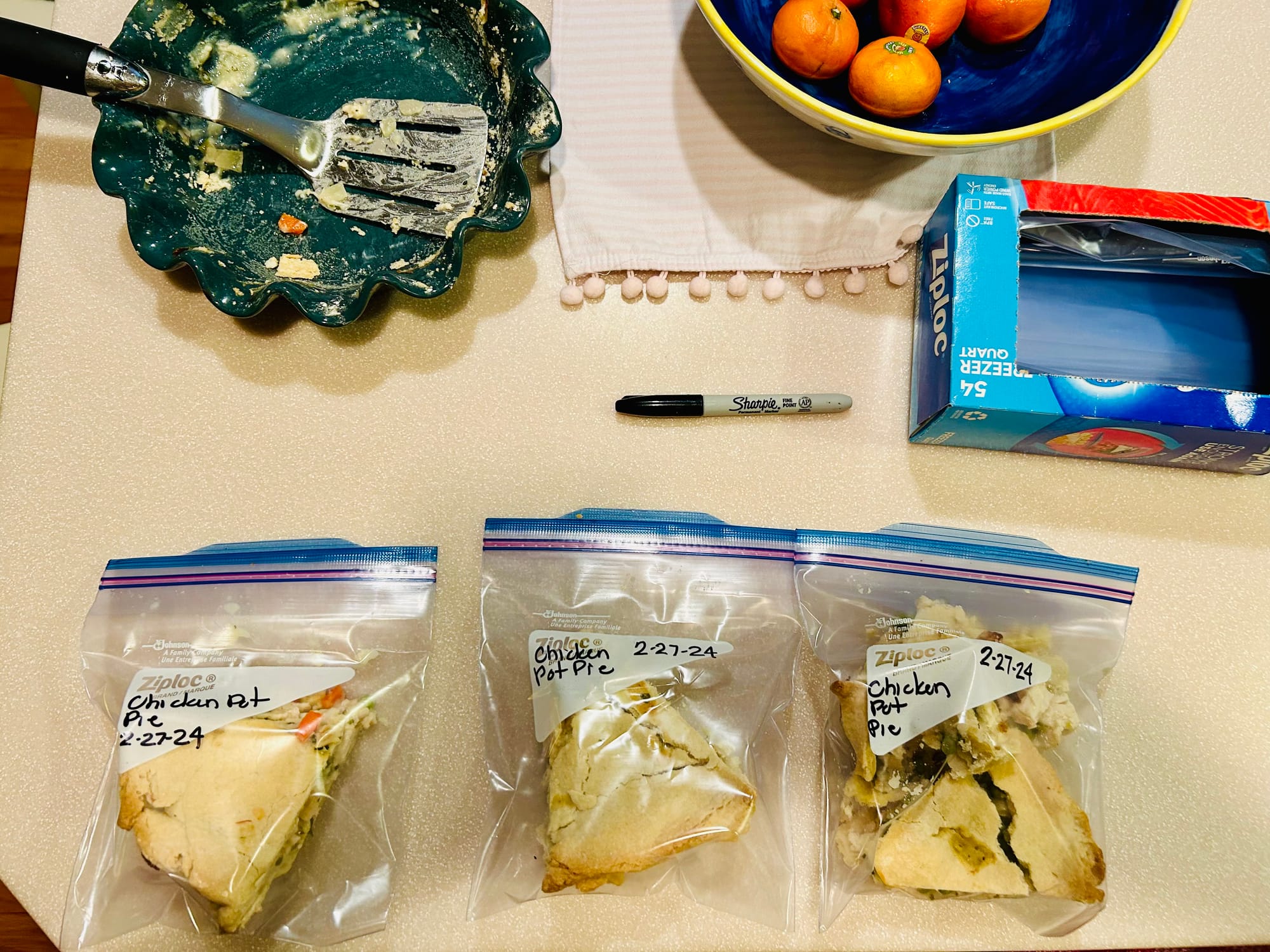

Saving leftovers of a good dinner for an Encore Meal or lunch to go are great ideas to make use of a delicious food when there is some left.

we could do tonight, as we clear the dinner table and the kitchen, what could we do to make the most of what we have here and not waste?” Look around the kitchen and point out, that there is more Chicken Pot Pie left. “Huh, what could we do with the left over Chicken Pot Pie?” Hopefully someone will say, Let’s freeze it in baggies and have it for dinner another night or someone could take it in their lunch tomorrow. If a child leaves too much uneaten food on their plates maybe you say to them, “I noticed that you didn’t eat too much. We don’t expect you to finish everything, but how about next time if you take a little less, eat what you have and get more, that way you won’t waste and there’s more for later. Any side dishes can be saved again for another meal, a snack or lunch on the go. Our kids liked taking their lunch. You can save so much money by taking lunch from home and you know what your kids are eating and who prepared it. My observation is that when kids start spending time in the kitchen and eventually being part of food preparation, they are more interested and engaged with their meal choices. Educate them on good nutrition, food safety and healthy food preparation. You know more about this than you think. Just start a conversation and you’ll see what I mean. Share your cost cutting tips with your kids. when kids are in the kitchen and they are part of the conversations, they are interested and become part of the solution. For kids to be part of the discussion on “How can we as a family save money and be smart?” This knowledge and information they can use for a life time. No matter how much money your make or have, saving money is part of any successful financial plan. Keep track of saving with coupons or weekly store specials. Show your kids the receipts and circle how much you saved that week at the grocery store. Let them start a ledger and keep track of savings, total savings for the month, quarter and year. These may be new vocabulary words for your kids. Good! Discuss that something IS NOT a deal if you don’t need it or won’t use it. Teach them, when appropriate, how to figure out cost per ounce and what a name brand is and compare with the no name brand. I could go on and on on this topic and feel that teaching kids about finances should be part of their compulsory education. This is your job as a parent. Think of what a service you are doing for your kids to teach them to be financially responsible. Just think of the basic principle of “You don’t spend for something if you don’t have the money to pay for it.” “DO you need it or want it?” Sow the seeds now of good financial judgement and your child will reap the benefits for many great days, even a life time.